IRA Benefit

If you are age 70 1/2 or older and have an IRA, a qualified charitable distribution allows you to transfer funds from your IRA directly to a charity. Such a donation would help satisfy required minimum distribution requirements, while reducing taxable income. Best of all, a gift from your IRA is an easy way to help change a child’s life by giving them the best possible start to their education. Talk to your financial planner to see if a qualified charitable IRA distribution is right for you.

For more information, please contact the Director of Development at 973-532-2501 or email development@preschooladvantage.org. Contact your IRA administrator with specific questions about your IRA.

Donation of Appreciated Securities

Case Study

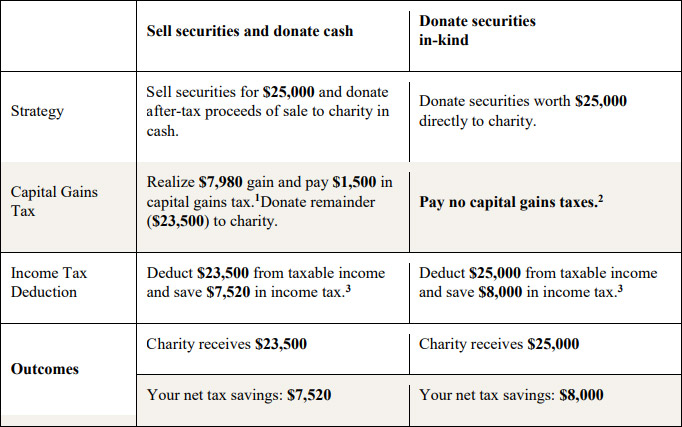

Make a bigger impact by donating long-term appreciated securities, including stock, bonds, and mutual funds, directly to charity. Compared with donating cash or selling your appreciated securities and contributing the after-tax proceeds, you may be able to automatically increase your gift and your tax deduction.

How does it work?

It’s simple and easy. When you donate stock to charity, you’ll generally take a tax deduction for the full fair market value. And because you are donating stock, your contribution and tax deduction may instantly increase over 15%. Would you prefer to donate bonds or mutual funds? The same benefits apply.

A larger gift and a larger deduction

The math: Suppose you are a taxpayer with $250,000 of adjusted gross income (AGI) and you wish to contribute to charity. You own appreciated securities with a market value of $25,000 that have appreciated by $7,980 since the purchase date. You have held the securities for more than one year, and long-term capital gains taxes apply. Below are two options for donating the appreciated securities to charity.

Planned Giving

Many individuals want to donate to Preschool Advantage but would like to contribute when they can be sure they no longer need their assets. For those individuals, naming Preschool Advantage as a beneficiary in their Will, Trust, or Retirement Account is the perfect solution. If you are thinking of making a Planned Gift to Preschool Advantage, please notify us so we can properly thank you and acknowledge your future gift, even if it is contingent.

Will or Trust

Residuary gift

You leave a percentage of your estate to Preschool Advantage after your estate expenses and specific bequests are paid.

Example: I give and devise to Preschool Advantage Inc located in Morristown, NJ, ten (10) percent of the rest, residue, and remainder of my estate, both real and personal, to be used for its general support.

Specific bequest

You designate a specific amount for Preschool Advantage in your planning document.

Example: I give and devise to Preschool Advantage Inc located in Morristown, NJ, the sum of one hundred thousand dollars ($100,000) to be used for its general support.

Contingent (back-up) bequest

You designate Preschool Advantage to recieve assets in the event your intended beneficiary does not survive you.

Example: I leave 10% of my residuary estate to my grandchild, Robert Jones, but if he predeceases me, then his share shall go to Preschool Advantage Inc located in Morristown, NJ, to be used for its general support.

Retirement Plan

Another way to benefit Preschool Advantage upon your death is to name Preschool Advantage as a beneficiary of all or a portion of your IRA, 401(k), 403(b), Keogh or profit-sharing pension plan.

Many individuals decide to name a charitable beneficiary to recieve assets in their income deffered retirement plans to avoid Federal Income Tax and State Income Tax, as well as Estate Taxes on those assets. Making a charitable gift from your retirement plan is easy. Simply request a change of beneficiary form from your plan administrator. Name Preschool Advantage Inc of Morristown, New Jersey as either a direct or contingent (back-up) beneficiary and return the form to your plan adminstrator.

Charitable Trusts

Talk to your financial advisor about Charitable Remainder Trusts which can allow donors to benefit both the charity of their choice and individuals they care about. Charitable Remainder Trusts are irrevocable trusts under which an annuity payment stream is paid to an individual beneficiary (often the donor or the donor’s spouse). At termination, whatever assets remain in the trust could be paid to Preschool Advantage.

In Charitable Lead Trusts, the roles of Charitable Remainder Trusts are flipped. The annuity goes to the charity of your choice. At termination, any remainder passes to individual beneficiaries.

In both cases, the owner recieves a current income tax deduction for the calculated value of the gift to the non-profit.

Times of unusually low or high interest rates modify the advantages of these types of gifts.

Thank you for considering including Preschool Advantage as a beneficiary in your Will, Trust, or Retirement Account. This support will help us serve children for years to come. Please advise us of changes to your estate planning that impact Preschool Advantage by calling 973-532-2501 so we can be sure to thank you and recognize your support.

The foregoing information should not be considered legal or tax advice. Please speak with your attorney and tax advisor before making any charge to your Estate Planning beneficiary designations.

Lend a Helping Hand

Your generous donations enable us to help families in need.